This article is the first installment in our new series called: “How SaaS Companies Are Building with GenAI.”

Introduction

Context on the data

Throughout the year, I’ve been closely monitoring the wave of generative AI (GenAI) releases by SaaS companies.

After reviewing over 2K press releases and filtering for only US-based SaaS companies, I curated a database that I could use to explore any trends.

Here’s a preview of the data.

Let’s dive in!

Key takeaways

If you are off in a rush, here’s the TL’DR:

- SaaS companies moved swiftly to launch GenAI products after the release of ChatGPT in November 2022

- The influx of GenAI launches was partly fueled by the accessibility of frameworks and third-party LLMs (plus the appetite from VCs)

- Traditional SaaS players opted for AI enablement to enhance their existing product offerings & and quickly capture market demand.

Riding the AI wave

SaaS companies move swiftly to launch generative AI products at the start of 2023

As the new year rolled in, so did a wave of generative AI announcements from SaaS companies.

The release of OpenAI’s ChatGPT last November sounded the opening bell for GenAI development.

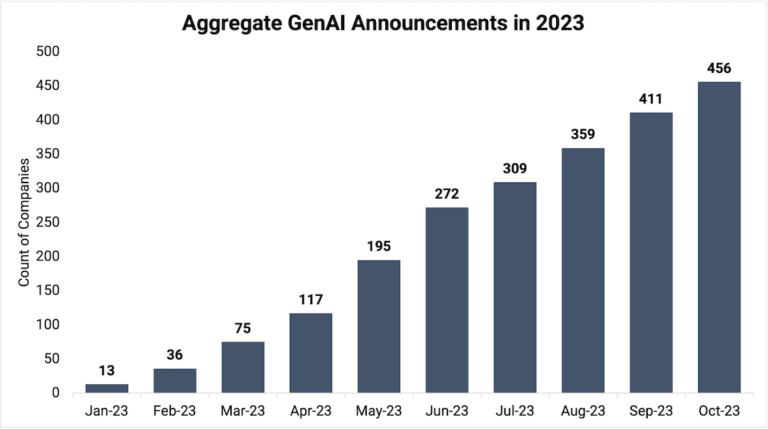

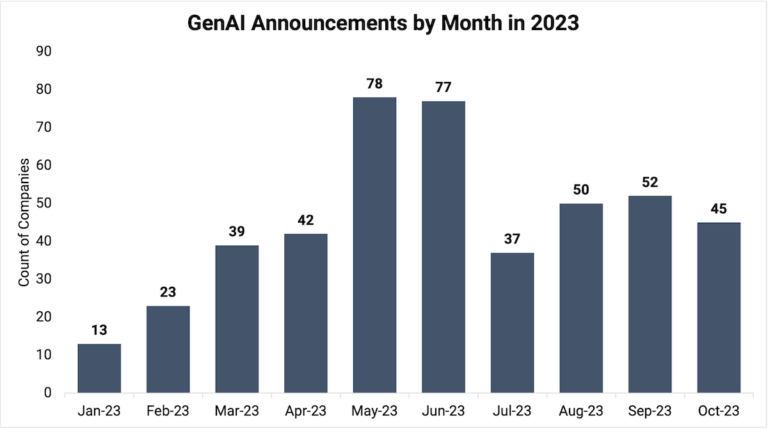

Over 270 SaaS companies launched GenAI products in the first half of the year, with announcements peaking in May and June and then leveling off in Q3.

Leading the charge, we saw big players make their moves early.

Salesforce rolled out Einstein GPT, HubSpot dropped ChatSpot, and Forethought announced SupportGPT, all within March.

These announcements became the trailblazer for other SaaS companies to follow suit.

Reviewing the trends in AI releases

As with many tech trends, interest around the topic ebbs and flows.

The number of GenAI launches peaked in May and June, followed by a gradual decline in the second half of 2023.

As a side note, this data doesn’t include the surge of single-use SaaS/GenAI applications popularized on platforms like X (formerly known as Twitter) and ProductHunt.

While I haven’t been tracking these announcements closely, the common thread I’m seeing is that launching GenAI apps has become a lot easier and the funding behind AI startups has fueled the craze.

Discover the SaaS companies building with GenAI!

Democratizing the development cycle

Open-source frameworks and LLMs have made releasing AI-based products easier and faster

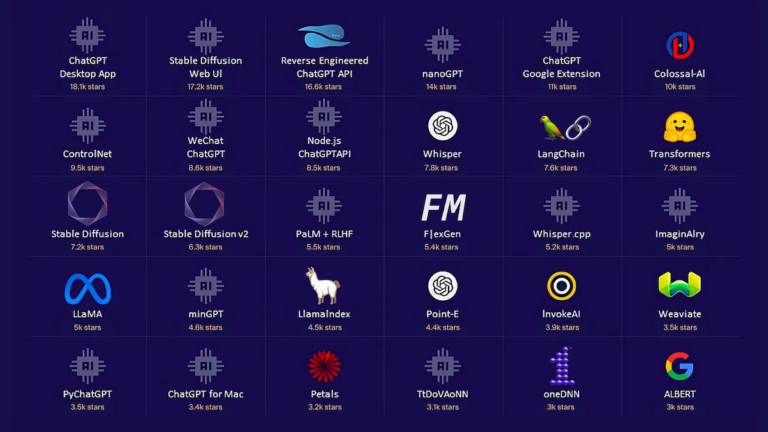

The growing ecosystem of available tools set the tempo for the new wave of GenAI solutions.

The release of helpful frameworks like LangChain and LlamaIndex reduced the development time for building AI products.

Plus, third-party LLMs like OpenAI’s GPT-4 and Anthropic’s Claude have increased the accessibility to leverage powerful models.

The Landscape of the Top Open-source AI Projects by Decibel VC

(Image sourced from Decibel VC)

As a result, SaaS companies were no longer limited by the lack of in-house models and engineering talent to release AI-powered products to their customers.

But with all nascent tech trends, tools are not the only thing that fuels growth: funding does as well.

More money, more products

I don’t have enough data to back this statement up, but it seemed like if you couldn’t raise capital, just add AI to your domain and watch the term sheets pour in.

Despite overall startup funding hitting a slump in 2023, investments in GenAI companies skyrocketed.

According to PitchBook data, global funding in GenAI companies hit $18.3B so far in 2023. Ignoring OpenAI and Anthropic’s massive rounds, deal value peaked in Q2 at $4.3B.

Global Generative AI VC Deal Value and Volume

(Source: PitchBook data, As of Sept. 30, 2023)

Double-clicking into the announcement data, 68 SaaS companies that have released GenAI products also raised capital in 2023, and about half of them closed their rounds after making their GenAI debut.

Whether the AI push contributed to a higher valuation can be left for debate, but one thing is for sure, AI funding is not going away.

The shift to AI solution

Traditional SaaS vendors opt for AI enablement to enhance their existing product offerings

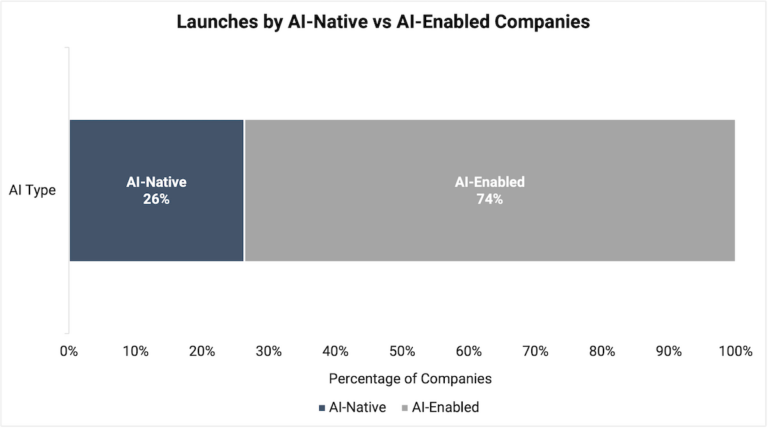

Over half of this year’s GenAI announcements originated from traditional SaaS companies.

This data shows an interesting shift, as traditional SaaS players are increasingly integrating AI to enhance their offerings and secure a competitive edge.

Plus, when we add broader context to the data, we can start to understand the strategy behind the adoption curve.

The move to become an AI-enabled vendor is either an offensive or defensive play for some companies.

Playing on the offense

On the offense, adding an AI layer elevates their value prop by leveraging existing moats, including proprietary data, verticalization of the workflow, or user distribution.

It’s also a way to signal that they’re ahead of the curve while leveraging the coverage around AI to amplify their marketing.

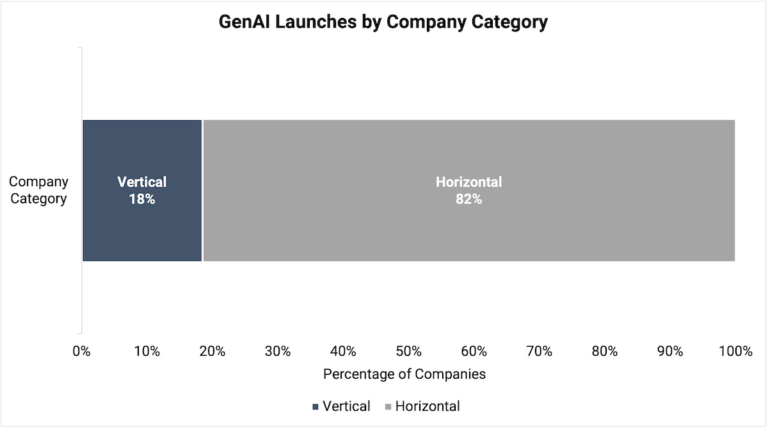

This is especially true for Vertical SaaS companies, where AI is a way to strengthen the best-of-breed product suite while expanding the dollar TAM through upsells.

Building out the defense

But then there’s the defense view. For SaaS incumbents, adopting AI is not so much a power play, but a defensive move to protect their position in the market.

These industry giants are increasingly under pressure to launch AI as a way to signal to their customers and investors that they are not falling behind competitors.

Elad has an insightful post covering the various layers of defensibility and the interplay between GenAI and traditional barriers.

A push towards product enhancements

How SaaS companies are adding generative AI into their product suite

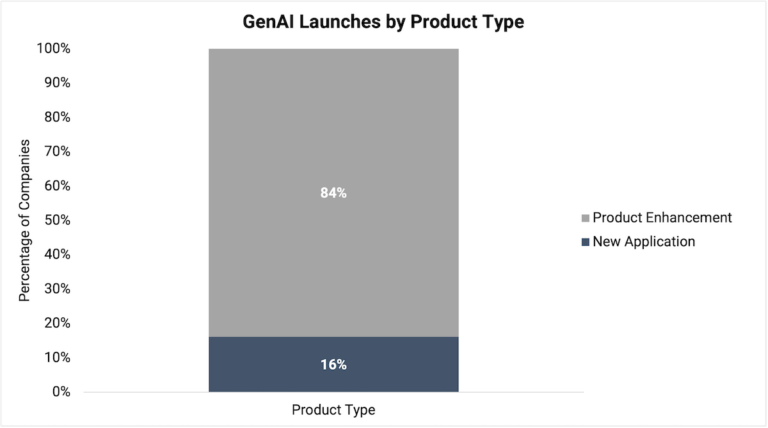

The majority of the GenAI launches this year were for product enhancement rather than new applications.

This makes sense given that it’s easier to integrate GenAI as a feature rather than developing it as a standalone product.

While some companies may have the maturity and infrastructure to build entire AI applications, other companies seem to be learning how to utilize AI.

I plan to cover this topic in more detail in a later post. In the meantime, here are a few of my favorite releases.